Wondering how you can make your money stretch further while raising a family in South Africa? Read on for tips that help you do just that…

According to MoneyWeb, South Africans can expect a 36.1% electricity price hike from April 2025. Crazy, right? Unfortunately, that’s not where it ends. Fuel, food, rent, medical aid, school fees… Our metaphorical belts continue to tighten daily, as we hope for inflation to drop and for the cost of living to allow us to live well.

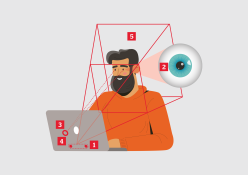

It may seem impossible to raise a family in this economic climate while also saving money for those rainy days and well-deserved treats and retreats, but it’s not! Freddie le Roux is a financial advisor at Envestpro, an affiliate of Liberty, and he shares five tips to help you create a realistic budget.

Annnd… Goal!

It may seem predictable for the first tip to be goal setting but according to Freddie, it is important to begin by having the end in mind. Start by setting yourself a specific goal – instead of saying something vague like ‘save more’, write down an amount that you want to save and the time frame over which you will save that amount, and prioritise this goal.

Be realistic and reasonable with yourself as there will always be unforeseeable expenses when raising a family, but never stray from your goal. “Whether it’s a long-term, short-term or medium-term goal will depend on one and the same strategy that would be adopted to save towards that goal,” he says.

Be wise, strategise

Now that you have a specific goal in mind, the next step is to put yor plan into action by crafting a budget that balances your wants and needs. It’s easier to draw up a plan than to follow it through, and so Freddie advises taking a look at your original budget, seeing if your funds are fulfilling more wants or needs than necessary, and reallocating those funds more appropriately. “One could find that there are hundreds, maybe even thousands, of rands that could be redirected into some form of savings vehicle,” he says.

Investment vehicles

An investment vehicle is a method or product that helps you invest and grow your money. “It’s all very well saving R100 a month for a year and ending up with R1 200 saved, but the value of R1 200 in 2025 versus 2035 are two different things. So, the money needs to grow to keep up with inflation,” Freddie explains. Of course, growing your savings will always come with some sort of risk so you need to do your research and consider and create a risk profile. Reaching out to a financial advisor would be most beneficial for such things. Here are some savings vehicles for you to consider: unit trusts, tax-free savings endowments and longer-term retirement annuities.

Technological Era

Another strategy you can implement is to track which of your household costs are fixed and which fluctuate. For example, your rent or mortgage, car licence, phone contract and streaming subscriptions are all fixed costs for the year, whereas fuel and food prices may fluctuate from month to month.

You can use techniques like setting up a debit order for fixed costs so that the payments are automatically deducted from your bank account. “This helps build up financial discipline over a period of time so that you commit to your goal,” says Freddie.

Other options that can help you save money include loyalty points, banking apps and the Stash App (an app a company like Liberty uses) where, depending on how you use it, a portion of the money you spend goes into a tax-free savings account. It would do you

a lot of good to research how these apps can help you save.

A ban on brands

Brand names are not a necessity. As a parent trying to balance a budget and plan for the future, it is essential to draw a line and save luxury items for when you can afford them.

Until then, don’t focus on the brand of clothing, shoes, food, tech or appliances that you purchase. We often pay for the name, not the product. So ask for the generic versions of the medication prescriptions you need.

The no-name products, generics or ‘dupes’ are just as good and won’t break your budget for a temporary bit of excitement.

Involve the family

It can often feel like our lives are controlled by how much money we make and how

we choose to spend it. You may be the main breadwinner of your family or a contributor, but tackling things as a unit will always lighten the load you carry.

Involve your kids in your goal setting when they are an appropriate age – share your saving goal and what you, as a family, need to cut down on or prioritise to achieve it. Involve them so that they understand and incorporate this way of budgeting into their lives in small ways. If they want a specific toy or item, teach them how to save for it, and help them help you in the present as you help them help themselves in the future.

“Equipping the next generation with financial knowledge and literacy, and giving them the necessary skills to survive and operate in this world after leaving school

– that’s another goal,” says Freddie.

Fun low-cost activities for your family:

- Pack a breakfast or lunch picnic.

- Visit a museum, botanical garden or animal sanctuary.

- Go fishing at a dam or river.

- Try an overnight camping trip.

- Go cycling or visit a bike park.

Photo: Shutterstock

Words by Thuveshnie Govender