POLICY AND DISCLOSURE NOTICE FOR THE LIFE INSURANCE BENEFITS WHICH FORM PART OF THE OPTIONAL CLUB PLATINUM PRODUCT (“the/this Policy”)

This is a life insurance Policy.

This document sets out the terms and conditions of the insurance benefits which form part of Your Club Platinum magazine subscription. This Policy provides You with death cover and account settlement cover if You meet all the conditions of this Policy.

This Policy is a legal document which must be read together with, and considering the following:

- The terms and conditions and disclosure notice;

- The account application form;

- Quotation and pre-agreement statement for small and intermediate credit agreements;

- Insurance disclosure;

- Credit facility agreement; and

- Any changes we have agreed in writing.

Your Club Platinum subscription is optional. This means that, when you subscribe to Club Platinum magazine, You will be covered by the Death Benefit and Account Settlement Benefit as set out in this Policy, but it is Your Beneficiary’s choice whether or not to claim for the Benefits when You die, and it is Your choice whether or not to subscribe to Club Platinum.

You must read this Policy carefully so that You understand when the Insurer will approve a Claim.

DEFINITIONS

Please make sure You understand the meaning of these important words, used in this document:

Beneficiary

means a person nominated by You as the person in respect of whom the Insurer should meet the Policy Death Benefit. If You do not nominate a person to be Your Beneficiary, You agree that the Claimant will be Your Beneficiary;

Benefit

means the amount or amounts payable on Your Death as defined in this Policy, and ‘Benefits’ shall have a corresponding meaning where the context so permits;

Claim

means, unless the context indicates otherwise, a demand for Benefits under this Policy by a Claimant, whether the Claimant’s demand is valid or not, made by handing in a completed and signed claim form with supporting documents to TFG, and ‘Claims’ shall have a corresponding meaning where the context so permits;

Claimant

means a person who makes a Claim in relation to this Policy and who must be Your surviving Partner, a person who is financially dependent on You, Your sibling (including a half sibling or step sibling) or parent (including a natural or legally adoptive parent);

Claim Event

means Your Death which happens after the Starting Date and during the insurance period;

Claim Event Date

means the date on which the Claim Event occurs, giving rise to a Claim;

Club Platinum Amount

means the monthly amount which You pay for Your Club Platinum subscription;

Credit Limit

means the maximum approved amount of credit in terms of Your TFG Money account;

Day

means a 24 (twenty-four) hour period, and ‘Days’ has a corresponding meaning where the context so permits;

Death

means Your death by any cause, subject to the Exclusions and the terms and conditions of this Policy;

Exclusion

means a loss or event not covered by this Policy. Should a Claim Event arise from an Exclusion, no Benefit will be payable. ‘Exclusions’ shall have a corresponding meaning where the context so permits;

Insolvency Act

means the Insolvency Act 24 of 1936;

Insurer

means the insurance company that underwrites this insurance, namely Guardrisk Life Limited (registration number 1999/013922/06 and FSP number 76), an authorised financial services provider and a licensed life insurer. See the disclosure notice for details;

Magistrates’ Courts Act

means the Magistrates’ Courts Act 32 of 1944;

National Credit Act

means the National Credit Act 34 of 2005;

Outstanding Balance

means the total amount that You owe TFG on Your TFG Money account from time to time or at the Claim Event Date;

Partner

means Your legal husband, wife or civil union spouse or a person that You are in a permanent relationship with and who shares a domicile (the address which a person treats as their permanent home) with You;

Personal Information

means personal information as defined in the Protection of Personal Information Act 4 of 2013;

Pre-existing Condition

means any condition that You were aware of, or that You have consulted a Doctor for, or that You have received medical treatment for before the Starting Date that results in a Claim Event;

Premium

means the monthly amount that You must pay to be covered by the Death Benefit and Account Settlement Benefit in terms of this Policy. The Premium is included in the Club Platinum Amount. We pay the Premium to the Insurer on Your behalf and recover the amount which We pay to the Insurer from You (see clause 4 for details);

Repudiate

means, in relation to a Claim, any action by which the Insurer rejects or refuses to pay a Claim or any part of a Claim, for any reason, and includes instances where a Claimant lodges a Claim

- in respect of a loss event not covered by this Policy; and

- in respect of a loss event or risk covered by this Policy, but the Premium payable in respect of this Policy has not been paid;

and ‘Repudiated’ shall have a corresponding meaning where the context so permits;

Starting Date

means the date when this Policy starts, which is the date when You sign the credit agreement and accept the for Your TFG Money account, or the date on which You take up this Policy over the telephone;

TFG Money account

means the store card account that You have with TFG;

Unclaimed Benefit

means a benefit in terms of an approved Claim where the Benefit can’t be paid to the Beneficiary within 3 (three) months of the Claim having been approved because the Beneficiary is not contactable. In other words, the Beneficiary cannot be located, his/her emails are undelivered, his/her post is returned to Us and/or his/her contact number is no longer in use;

Variation

means any act that results in a change to –

i. the Premium,

ii. any term,

iii. any condition,

iv. any Policy Benefit,

v. any Exclusion, or

vi. the duration of this Policy,

and ‘Vary’ and ‘Varied’ shall have a corresponding meaning where the context so permits;

We/Us/TFG

means Foschini Retail Group (Pty) Ltd (registration number 1988/007302/07 and FSP number 32719). The stores in our group are called TFG Stores in this Policy. We provide services as an intermediary between You and the Insurer. See the disclosure notice for details;

Welcome Letter

means the letter sent to You from Us confirming that You are covered by this Policy and that You have consented to taking up this Policy;

You/Your

means the South African person who is older than 18 (eighteen) who has applied for a TFG Money account, which application has been accepted by TFG and who has chosen to subscribe to Club Platinum. You are the person who will be insured by the Benefits in terms of this Policy.

1. Insurance Period

You are only insured while You have valid insurance. You have valid insurance if all the terms and conditions of this Policy are met and if You have paid the monthly amount required by Us on Your TFG Money account (see clause 1.1).

This Policy will suspend (You will not have cover and You will not be billed for an amount equal to the Club Platinum Amount) when:

1.1 You have not paid the monthly amount required by Us on Your TFG Money account for 2 (two) consecutive months. You may contact TFG’s customer services on 0860 834 834 if You would like to know what this amount is. We will notify You in writing when You have not paid this amount);

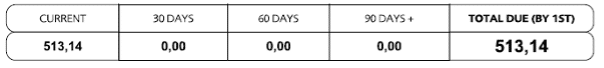

1.2 There is any amount on Your TFG Money account that is outstanding for 60 (sixty) days or more. This means that, in order for You to have cover, the 60 (sixty) day indicator and the 90 (ninety) day indicator on the bottom of Your account statement each month must be zero as per this example:

TFG will notify You in writing when there is an amount outstanding for 60 (sixty) days or more.

1.3 You are under debt review as provided for in the National Credit Act;

1.4 You are under administration as provided for in the Magistrates’ Courts Act;

1.5 You become insolvent as provided for in the Insolvency Act;

1.6 You reach Your Credit Limit;

As concerns the Account Settlement Benefit only:

1.7 The interest, costs and fees on Your TFG Money account equal Your total balance at default, as per section 103(5) of the NCA. In such an event, You may contact Us on 0860 834 834 and We will advise You of the payment You need to make to ensure that the cover under this Policy is reinstated. If this happens, You will not have cover under the Account Settlement Benefit and You will not be billed that portion of the Club Platinum Amount which is the amount equal to the premium for the Account Settlement Benefit;

As soon as any of the circumstances listed above at 1.1 to 1.7 come to an end or no longer apply, the applicable Benefit(s) under this Policy will reinstate automatically from that date and You will receive notice that cover is reinstated from that date onwards. There is no cover under the Policy for the period that the Policy has been suspended and the Claimant will not be able to lodge a Claim for any event happening in the period that the Policy has been suspended. You will receive confirmation from TFG if and when the Policy suspends. See clause 6 for details on when this Policy will end.

This insurance will start on the Starting Date.

2. Benefits – what We cover

2.1 Death: on Your Death (when You die), the Insurer will pay the capital sum of R10 000.00 (ten thousand rand) to Your nominated Beneficiary.

If You subscribed to Club Platinum on or after 1 August 2014: The Death Benefit in the amount of R10 000.00 (ten thousand rand) will automatically reduce to the amount of R2 000.00 (two thousand rand) on the day that You turn 65.

If You subscribed to Club Platinum before 1 August 2014: The Death Benefit will stay R10 000.00 (ten thousand rand), regardless of Your age.

2.2 Account Settlement: on Your Death during the currency of Your TFG Money account, the Insurer will settle (pay) the Outstanding Balance on Your TFG Money account, calculated on the Claim Event Date, up to a maximum settlement amount of R10 000.00 (ten thousand rand).

If You subscribed to Club Platinum on or after 1 August 2014: The Account Settlement Benefit in the amount of R10 000.00 (ten thousand rand) will automatically reduce to the amount of R1 500.00 (one thousand five hundred rand) on the day that You turn 65.

If You subscribed to Club Platinum before 1 August 2014: The Account Settlement Benefit will stay R10 000.00 (ten thousand rand), regardless of Your age.

The amount payable under the Account Settlement Benefit will be paid directly to TFG, and not to any other person/entity.

3. Specific Exclusions (what is not covered)

The Insurer will not cover Death which is caused by You:

3.1 Abusing alcohol, drugs or narcotics or being affected by insanity;

3.2 Actively participating in war, invasion, acts of foreign enemies, hostilities, warlike operations (whether war be declared or not), civil war, insurrection, rebellion or revolution, civil commotion or uprisings, military or usurped power, mutiny, martial law or state of siege or any other event or cause which determines the proclamation or maintenance of martial law or state of siege;

3.3 Performing any act, or any attempting to perform any act (whether on behalf of any organisation, body or person, or group of persons) calculated or directed to overthrow or influence any State of Government, or any provincial, local or tribal authority with force, or by means of fear, terrorism or violence;

3.4 The act of any lawfully established authority in controlling, preventing, suppressing or in any other way dealing with any occurrence referred to in clauses 3.2 and 3.3 above.

3.5 Using nuclear, biological or chemical weapons, or any radioactive contamination;

3.6 Active participation in the commission of a criminal act resulting in a Claim Event;

3.7 Participating in hazardous activities such as mountain climbing, bungee jumping and speed racing;

3.8 committing or attempting to commit suicide or wilful self-injury; or

If the Insurer alleges that by reason of clauses 3.1 to 3.8 above Your Death is not covered by this Policy, the burden of proving the contrary shall rest on the Claimant.

The Insurer shall not be liable for loss or damage caused directly or indirectly by or through or in consequence of any occurrence for which a fund has been established in terms of the War Damage Insurance and Compensation Act, 1976, or any similar Act.

This Policy does not cover any consequential loss, which is loss because of Your Death, for example, if You were the primary breadwinner for Your family and You can no longer provide for Your family because You have died.

4. Premium

4.1 The Premium is R4.33 per month and is included in the Club Platinum Amount.

4.2 The monthly Premium for the Death Benefit is R3.27, which is included in the Club Platinum Amount. The monthly premium for the Account Settlement Benefit is R1.06 which is included in the Club Platinum Amount.

Disclosure in terms of Section 106(5)(b) of the National Credit Act 34 of 2005

Please take notice that, in terms of Section 106 (5) (b) of the Act, the purchase of the credit insurance policy offered by TFG to You accrues the following:

Costs of the credit insurance for which You are liable

R1.06

Commission payable to TFG in relation to the Policy

R0.00

Premium payable

R1.06

4.3 We will pay the Premium to the Insurer on Your behalf each month. We will recover the Premium which We pay to the Insurer each month from You by debiting an amount equal to the Club Platinum Amount (which includes the Premium paid on Your behalf) to Your TFG Money account every month. This debit will show on Your TFG Money account statement each month as an item that You bought.

4.4 The Premium may be increased once during a calendar year, but We will give You 31 (thirty-one) Days’ notice of any Premium changes, the reason for the changes and if the change will result in a change to the Benefits. The notice will also tell You what steps You can take, including giving the You an opportunity to cancel the Policy, if You are not happy with the Variation/Variations. The following factors will be considered before a premium increase is decided:

4.4.1 past and future expected economic factors (for example, but not limited to, interest rates, tax and inflation);

4.4.2 past and future expected lapse experience;

4.4.3 past and future expected mortality experience;

4.4.4 expected future reinsurance;

4.4.5 past and future claims experience;

4.4.6 any regulatory and legislative changes impacting this Policy; and

4.4.7 any other factor impacting the Premium that the Insurer deems material at the time.

The increased amount will be debited to Your TFG Money account from the effective date of the increase.

4.5 The terms and conditions for a TFG Money account also apply to this Policy. Your TFG Money account is a credit facility which may attract interest. The billing of the amount equal to the Club Platinum Amount from Your TFG Money account results in an interest-bearing debt in terms of Your TFG Money account terms and conditions, You will be liable for this interest, which We will keep. Please refer to the terms and conditions for a TFG Money account for information on the payment plan and interest rates that apply.

4.6 If You subscribed to Club Platinum prior to 1 August 2014: Where You elect not to be charged the Club Platinum Amount if Your TFG Money account has a zero or credit balance, no cover and benefits will be in force. When Your TFG Money account becomes active again, which means that You made a purchase on Your TFG Money account, Club Platinum cover and benefits will automatically start again.

4.7 If You subscribed to Club Platinum on 1 August 2014 or thereafter: the Club Platinum Amount will be debited to Your TFG Money account (and We will pay the Premium to the Insurer) whether Your TFG Money account has a debit (negative) balance, a balance of zero or a credit (positive) balance and the cover and benefits will be in force regardless of the Outstanding Balance.

4.8 It is Your responsibility to check Your monthly TFG Money account statement, to make ensure that the Club Platinum Amount is being debited. If the Club Platinum Amount is not being debited, please urgently contact TFG customer services on 0860 834 834.

5. How to claim

A Claim must be made in writing within 3 (three) months after the Claim Event for unnatural death and within 4 (four) months after the Claim Event for natural death.

A claim form is attached to the Welcome Letter. If You have lost the claim form that was attached to the Welcome Letter, You (or the Claimant) may request a copy from any TFG store, or download a claim form on TFG’s insurance website at www.tfginsurance.co.za or contact the Insurance Claims Department and request a claim form to be sent to You (the contact details are further down in this clause).

You can notify Us of a Claim by clicking on the claims notification tab on Our website at www.tfginsurance.co.za, but the Claimant will still be required to complete, sign and submit a claim form as indicated below.

To make a Claim, the Claimant must email the completed and signed claim form with supporting documents listed below to the Insurance Claims Department at claimsadmin@tfg.co.za. If the Claimant does not have access to email, he/she can go to his/her closest TFG Store and hand in a fully completed and signed claim form with the documents listed below.

The following documents must be handed in with the claim form:

- A certified copy of Your death certificate;

- A certified copy of the Claimant’s identity document;

- A certified copy of Your identity document;

- A certified copy of the Beneficiary’s identity document;

- Any other documents or information that We require, including affidavits as detailed on the claim form.

The TFG store staff will email the Claim documents to the TFG Insurance Claims Department, or You can fax or email them yourself. Contact details for the Insurance Claims Department are

- fax number: 021 937 5274;

- sharecall number: 0860 000 388; and

- email: claimsadmin@tfg.co.za.

Notification of all Claims that are submitted to Us under this Policy shall be made to the Insurer by Us, on the Claimant’s behalf.

A Claim shall not be payable if the conditions set out in this paragraph 5 are not met. If there is any fraud in relation to a Claim, You will not be covered by this Policy at all

We will let You know if the Insurer has accepted and approved Your Claim.

Unclaimed Benefit

If the Death Benefit under this Policy is an Unclaimed Benefit, We will take action to determine if the Beneficiary is alive and/or aware of the Benefit payable to him/her under this Policy. Specifically, in the 3 (three) year period after the Unclaimed Benefit arises, We will:

- attempt to contact the Beneficiary telephonically and electronically to advise them of the Unclaimed Benefit; or

- determine the last known contact information of the Beneficiary by comparing internal and external databases, including the use of internet search engines and/or social media; or

- appoint an external tracing company to locate the Beneficiary.

Before the end of the 3 (three) year period referred to above, We will confirm the Unclaimed Benefit and transfer the amount of the Unclaimed Benefit to an account in the name of the Insurer, and the Insurer will accept liability for the Unclaimed Benefit.

Repudiation

If a Claim is Repudiated by the Insurer, We will let the Claimant know in writing within 10 (ten) Days of the decision to Repudiate the Claim.

If the Claimant disputes the Insurer’s Repudiation of his/her Claim, he/she has 90 (ninety) Days from the date he/she receives the repudiation letter to appeal this decision in writing to the Insurer. The Insurer’s contact details are in the Disclosure Notice which is attached to this Policy.

If the appeal is not successful or the dispute is not resolved at the end of this 90 (ninety) Day period then the Claimant has an additional 6 (six) months to institute legal action against the Insurer by serving summons on it, failing which the Insurer is no longer liable in respect of the Claim.

Please contact TFG’s Insurance Claims Department for a copy of TFG’s Claims Management Framework. The telephone number is 0860 000 388.

Complaints

If You have a complaint, You can make Your complaint to Us or to the Insurer by using the contact details in the Disclosure Notice below.

If any complaint to TFG or the Insurer is not resolved to Your satisfaction, You may submit a complaint to the National Financial Ombud Scheme or the FAIS Ombudsman (see the Disclosure Notice for the Ombudsmans’ contact details) or the Financial Sector Conduct Authority, which is the regulator of the long-term insurance industry (see the Disclosure Notice for their contact details).

6. When this Policy will end

6.1 The Insurer can end this insurance by giving You 31 (thirty one) Days’ notice in writing, to your last known address, to Your email address or via SMS.

6.2 This Policy will automatically end

6.2.1 when You die; or

6.2.2 when Your TFG Money account is terminated;

whichever of these events happens first.

6.3 You may cancel Your Club Platinum magazine subscription (which includes the insurance benefits) at any time by contacting TFG’s customer services on 0860 834 834. Cover will stop at midnight on the last day for which the Club Platinum Amount has been paid.

6.4 The Insurer may immediately cancel this Policy, or place it on hold, refuse any transactions or instructions, or take any other action considered necessary in order to comply with the law and prevent or stop any undesirable or criminal activity.

7. Variations to this Policy

The Insurer reserves the right to Vary the terms and conditions of this Policy by giving 31 Days’ written notice to You of its intention to do so. Any Variations and or changes will be binding on You and the Insurer and can be applied at any time to the existing terms and conditions after written communication of these changes has been sent to Your last known address as it appears in the Insurer’s records at that time.

8. Your duties in respect of this Policy

8.1 You must always give Us information that is to the best of Your knowledge:

- True and correct

- Complete – make sure nothing is missing.

8.2 It is Your responsibility to tell us about all relevant changes to Your details or circumstances and all relevant details about a Claim You or the Claimant makes.

8.3 If You do not give true, correct and complete information, the Insurer may:

- end this Policy. If this happens, You will not get the Premium which has been paid, back, and/or

- refuse to pay out a Claim. If this happens, You will not get the Premium which has been paid, back.

8.4 You must not commit fraud or make a fraudulent Claim. If You commit fraud or submit a Claim that is in any way fraudulent, We will lay charges with the police and not pay out Your insurance Claim. We will also not refund any Premium which has been paid.

9. Jurisdiction and governing law

Only the courts of the Republic of South Africa shall have jurisdiction to entertain any claims arising out of or in respect of this Policy and the law of the Republic of South Africa shall apply to this Policy.

You consent to the jurisdiction of the High Court of South Africa, Gauteng Local Division, Johannesburg, in respect of all claims and causes of action between You, the Insurer and/or TFG, whether now or in the future, arising out of or in respect of this Policy.

10. Indulgence, leniency or extension

If We allow You any indulgences, it does not affect our rights under this Policy. It also does not mean that We must allow You any similar indulgences again. For example, if We give you extra time to pay the Club Platinum Amount on one occasion, We do not have to give You extra time to pay the Club Platinum Amount on another occasion.

11. Treating Customers Fairly

We have created a superior solution – encompassing products, processing and service – tailored to each of our customers’ requirements. We will, at all times, deliver a superior customer experience, simplifying and improving our customers’ lives. We will achieve this through a motivated team of skilled people, absolute fairness in our treatment of our customers and partners and complying with the principles and outcomes of Treating Customers Fairly. These are:

- You are confident that Your fair treatment is key to our culture

- Products and services are designed to meet Your needs

- We will communicate clearly, appropriately and on time

- We are not licensed to give advice. Queries regarding advice must be referred to the Insurer

- Our products and services meet Your standards and are of an acceptable level

- There are no barriers to access our services, switch providers, make a claim or to lodge any complaints

12. Processing and protection of Personal Information

12.1 For the purposes of this section, “Applicable Laws” shall mean the Protection of Personal Information Act 4 of 2013 and any other legislation referring to data management and such processes.

12.2 Your privacy is of utmost importance to TFG and the Insurer. TFG and the Insurer will take the necessary measures to ensure that any and all information, provided by You or which is collected from You is processed in accordance with the provisions of the Protection of Personal Information Act 4 of 2013 and further, is stored in a safe and secure manner.

12.3 You agree to give honest, accurate and up-to-date Personal Information and to maintain and update such information when necessary. You have the right to access Your Personal Information held by TFG or the Insurer, during office hours and within a reasonable time after receiving such a written request for access. You may update Your Personal Information at any time by calling TFG.

12.4 You accept and expressly consents that Your Personal Information collected by TFG and/or the Insurer may be used for the following reasons:

12.4.1 to establish and verify Your identity in terms of the Applicable Laws;

12.4.2 to enter into this Policy and to enable the Insurer, TFG and either of their authorised representatives to fulfil their obligations in terms of this Policy and to comply with Your instructions;

12.4.3 to enable the Insurer and TFG to detect fraud and criminal activities and to take the necessary measures to prevent any suspicious or fraudulent activity in terms of the Applicable Laws;

12.4.4 reporting to the relevant regulatory authority/body, in terms of the Applicable Laws; and

12.4.5 to carry out the activities referenced at clause 5 above in relation to an Unclaimed Benefit.

12.5 You expressly consent to TFG and the Insurer sharing Your Personal Information with third parties to administer this Policy and comply with any regulatory requests. TFG and the Insurer may share Your information for further processing with the following third parties, which third parties have an obligation to keep Your Personal Information secure and confidential

12.5.1 payment processing service providers, merchants, banks and other persons that assist with the processing of Your payment instructions;

12.5.2 law enforcement and fraud prevention agencies and other persons tasked with the prevention and prosecution of crime;

12.5.3 regulatory authorities, industry ombudsmen, governmental departments, local and international tax authorities, and other persons that TFG and the Insurer, in accordance with the Applicable Laws, are required to share Your Personal Information with;

12.5.4 credit bureau’s;

12.5.5 TFG’s and the Insurer’s service providers, agents and sub-contractors that have been contracted by TFG or the Insurer to offer and provide products and services to You in respect of this policy; and

12.5.6 persons to whom TFG or the Insurer cede their rights or delegate their authority in terms of this Policy.

12.6 TFG and the Insurer will only keep Your Personal Information for as long as necessary or required by law.

12.7 Unless You consent thereto, TFG and the Insurer will not sell, exchange, transfer, rent or otherwise make available Your Personal Information to any other parties and You indemnify TFG and the Insurer from any claims resulting from disclosures made with Your consent.

12.8 You understand that if TFG/Insurer has utilised Your Personal Information contrary to the Applicable Laws, You have the right to lodge a complaint with Guardrisk or with the Information Regulator.

Disclosure Notice

Long-term Insurance Policyholder Protection Rules 2017 (PPRs)

Financial Advisory and Intermediary Services (FAIS) General Code of Conduct 2003

Your Intermediary

Business Name:

Foschini Retail Group (Pty) Ltd

Registration number:

1988/007302/07

Physical address:

Stanley Lewis Centre, 340 Voortrekker Road, Parow East, 7500

Postal address:

P O Box 6020, Parow East, 7501

Telephone:

0860 834 834

Email address:

Website:

FAIS registration (FSP No):

32719

In terms of the FSP license, Foschini Retail Group (Pty) Ltd is authorised to provide intermediary services for products under Long-term Insurance Category B1.

Without in any way limiting and subject to the other provisions of the Services Agreement/Mandate, Foschini Retail Group (Pty) Ltd accepts responsibility for the lawful actions of their representatives (as defined in the Financial Advisory and Intermediary Service Act) in rendering financial services within the course and scope of their employment. Some representatives may be rendering services under supervision and will inform you accordingly.

TFG is committed to combating money-laundering and terrorist finance as required by the Financial Intelligence Centre Act 38 of 2001, as amended. As such, you are required to inform us if you are a domestic prominent influential person (DPIP) or foreign prominent public official (FPIP) as defined in said Act. If your status changes (I.e. you become a DPIP or FPIP after taking up this Policy, you are also required to keep TFG informed.

Legal and contractual relationship with the Insurer: Foschini Retail Group (Pty) Ltd is an authorised financial services provider and registered credit provider in terms of the National Credit Act (NCRCP#36). Foschini Retail Group (Pty) Ltd performs services as an intermediary and binder holder under the Long-Term Insurance Act, the Financial Advisory and Intermediary Services Act and its Regulations, entering into life policies. It has an agreement with Guardrisk Life Limited, a cell captive insurer, and has the necessary mandates to act on behalf of Guardrisk Life Limited and acts in accordance with the mandate which is in place. Guardrisk Life Limited and Foschini Retail Group (Pty) Ltd have concluded a shareholder and subscription agreement that entitles Foschini Retail Group (Pty) Ltd to place insurance business with Guardrisk Life Limited. The shareholder and subscription agreement entitles Foschini Retail Group (Pty) Ltd to share in the profits and losses generated by the insurance business. Guardrisk Life Limited may distribute dividends, at the sole discretion of its Board of Directors, to Foschini Retail Group (Pty) Ltd during the existence of the Policy.

Professional Indemnity Cover: Foschini Retail Group (Pty) Ltd holds Professional Indemnity insurance cover.

Claims Procedure including prescription period: please contact Foschini Retail Group (Pty) Ltd’s Insurance Claims Department for a copy of Foschini Retail Group (Pty) Ltd’s Claims Management Framework.

Complaints Procedures: If you have a complaint, or if you would like a copy of the Foschini Retail Group (Pty) Ltd’s Complaints Management Framework, kindly visit our website, call Customer Services on 0860 834 834 or email us at customerservices@tfg.co.za.

For all complaints, please first address your complaint with us, the Administrator, as we would like to try and resolve it. If we have not been able to assist satisfactorily, then you may elevate your complaint to Guardrisk. See below for Guardrisk’s full contact details.

If the complaint to Guardrisk is not resolved to your satisfaction, you may submit the insurance complaint to the Industry Regulators, whose details appear below.

Compliance Officer: Antonio Jacobus, telephone number 021 938 1911 and email antonioj@tfg.co.za

Conflict of Interest: please call Customer Services on 0860 834 834 for a copy of Foschini Retail Group (Pty) Ltd’s Conflict of Interests Policy.

Your Insurer

Business Name:

Guardrisk Life Limited

Registration number:

1999/013922/06

Physical address:

The Marc, Tower 2, 129 Rivonia Road, Sandton, 2196

Postal address:

PO Box 786015, Sandton, 2146

Telephone:

+27-11-669-1000

Web:

FAIS registration:

FSP 76

In terms of the FSP license, Guardrisk Life Limited is authorised to give advice and render financial services for products under:

CATEGORY I:

- Long-term Insurance : Category A

- Long-term Insurance : Category B1

- Long-term Insurance: Category B1-A

- Long-term Insurance : Category B2

- Long-term Insurance: Category B2-A

- Long-term Insurance : Category C

Professional Indemnity and/or Fidelity Cover:

Guardrisk has a Professional Indemnity Cover and a Fidelity Guarantee Cover in place.

Compliance Details

Telephone:

+27-11-669-1000

Email:

Complaints Details

Telephone:

0860 333 361

Email:

Website:

Conflict of Interest :

Guardrisk Life Limited has a conflict of interest management policy in place and is available to clients on the website.

Policy Wording

A copy of the policy wording can be obtained from Foschini Retail Group (Pty) Ltd’s website (details above).

Policy details

The Policy document and Welcome Letter detail the type of policy, risk covered and the policy benefits.

Premiums

The Policy document and Welcome Letter detail the frequency of premium payments and the amount which is due. The Policy document and Welcome Letter also detail the manner of payment of the premiums, their due date and consequences of non-payment.

Fees

There are no fees payable under this policy.

Other matters of importance

You will be informed of any material changes to the information about the intermediary, insurer and or underwriter provided above.

If we fail to resolve your complaint satisfactorily, you may submit your complaint to the National Financial Ombud Scheme.

You will always be given a reason for the repudiation of your claim.

If the insurer wishes to cancel your policy, the insurer will give you 31 days’ written notice, to your last known address.

You will always be entitled to a copy of your policy at no charge.

Warning

Do not sign any blank or partially completed application form.

Complete all forms in ink.

Keep notes of what is said to you and all documents handed to you.

Where applicable, call recordings will be made available to you.

Don’t be pressurised to buy the product. You have the right to refuse the offer of this insurance.

Failure to provide correct or full relevant information may influence an insurer on any claims arising from your contract of insurance.

Waiver of Rights

No insurer and/or intermediary may request or induce in any manner a client to waive any right or benefit conferred on the client by/or in terms of any provisions of the said Code, or recognise, accept or act on any such waiver by a client. Any such waiver is null and void.

National Financial Ombud Scheme

(For claims/service related matters)

Physical address (Cape Town):

Claremont Building, 6th Floor, 6 Vineyard Road, Claremont, 7708

Physical address (Johannesburg):

110 Oxford Road, Houghton Estate, Illovo, 2198

Telephone:

0860 800 900

Email address:

info@nfosa.co.za

Website

Particulars of the Financial Sector Conduct Authority

(For market conduct related matters)

Postal address:

PO Box 35655, Menlo Park, 0102

Telephone:

+27-12- 428-8000

Fax number:

+27- 12- 346- 6941

Email address:

info@fsca.zo.za

Particulars of FAIS Ombudsman

(For product related matters)

Postal address:

PO Box 41, Menlyn Park, 0063

Telephone:

+27- 12- 762- 5000

Sharecall:

086 066 3274

Email address:

Particulars of the Information Regulator

(For personal information related matters)

Postal address:

PO Box 31533, Braamfontein, Johannesburg, 2017

Telephone:

+27- 010- 023- 5200

Email address:

POPIAComplaints@inforegulator.org.za