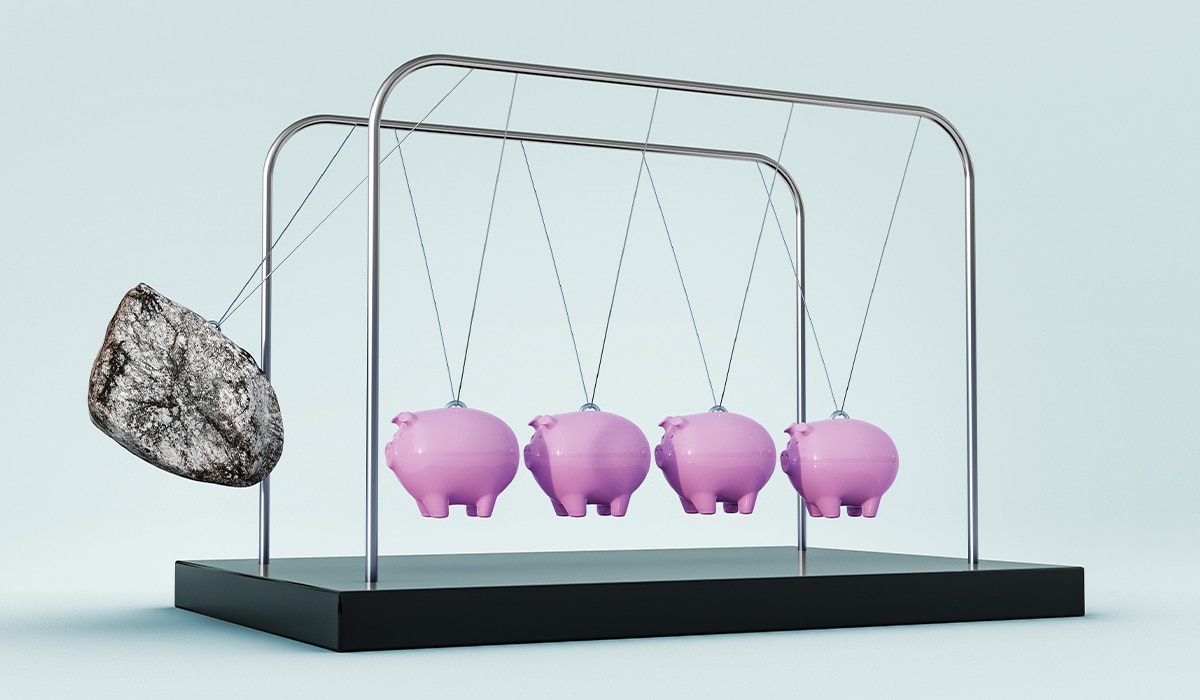

We all know we should curb our spending, yet many of us still tend to blow our earnings without proper planning. We offer tips to help you cut back what you dole out.

Those who have a little (or a lot) of expendable income know the basics of budgeting – don’t spend more than you earn. So why do so many of us still do it? Karin Schimke investigates the psychology of saving.

Employed people generally know they must save money — for old age, emergencies and big dreams — but they don’t. ‘It seems to be human nature,’ says Netto Invest financial planner Jennifer Nedzamba. ‘Knowing something is good for us is not enough to get us to do it.’

South African consumers are notoriously good at accumulating debt and bad at saving money. This is despite an instinctive understanding that, while money can’t buy love or happiness, it can certainly give you peace of mind.

‘As with maintaining a healthy body, most people know the best practices or basics,’ says personal leadership coach Roland Cox, ‘but the learned behaviours we have mean we’re driven by deeply personal motivations for spending rather than saving. These have many different forms but arguably rest on the fundamentals of fear, anger or shame around money.’

The main barrier to saving seems to be simply the rationalisations we provide for not doing so. ‘I can’t afford to save’ is a classic rationalisation, says Cox.

Think You Don’t Have Enough To Save?

Not saving because you think you don’t have the money to is an excuse. ‘Saving is a decision, then a habit,’ says Cox. ‘It doesn’t matter how small the amount that you receive is, as long as you put a percentage of it away. And then repeat this regularly so that it’s not noticeable on a monthly basis, but effective in the long run.’

‘WHILE MONEY CAN’T BUY LOVE OR HAPPINESS, IT CAN CERTAINLY GIVE YOU PEACE OF MIND.’

This has been called the ‘get rich slow’ way of growing your financial stability and it flies in the face of what we all really want, but which is seldom within our reach: the ‘get rich quick’ way of thinking.

The psychology of personal finance is an area that is being studied more and more as it has become clearer to economists that money is a highly emotional topic.

For this reason, explains Nedzamba, it’s often useful to involve an objective third party. Using someone to help set realistic and achievable financial goals that considers your very specific situation often turns out to be an investment on its own.

Instant Rewards

One of the most common self-sabotaging behaviours around not saving is giving in to the pressures or desires you feel now. These could include ‘looking better’ or ‘having new things’.

But the rewards from feeding these ‘wants’ are generally short-lived and are ultimately unsatisfying as rewards for the hard work we put in to earn the money. ‘As we repeat this behaviour it becomes a habit, and our fearful, angry or shameful behaviour around money grows stronger. This vicious cycle is hard to beat, but it can be overcome through small, crucial wins,’ says Cox.

‘ IF YOU DON’T KNOW HOW MUCH YOU SPEND, YOU’RE NOT GOING TO KNOW HOW MUCH YOU CAN OR NEED TO SAVE.’

Fritter Or Blow?

Some people fritter their money away, others blow it on big buys. ‘But I do think all people seriously underestimate the little expenses,’ says Cox.

There are a few old adages about the compounding effect of small amounts, and that goes for effort and habits as well as money and savings. Small wins are vital — it’s a slow and steady race. And a muscle that strengthens itself once it reaches a tipping point.’

Planning Not To Fail

To use Cox’s example of staying healthy, most people know that if you don’t plan exercise into your week like a meeting you need to have with yourself, you’re going to skip this vital part of life maintenance. Similarly, if you don’t know how much you spend, you’re not going to know how much you can or need to save.

Since the various savings options can seem overwhelming, we sometimes avoid thinking about them at all. Nedzamba says that when there’s something we can’t get our head around or we have some difficulty understanding, we put off making decisions about it. So, starting with a simple monthly budget is the first step to not failing to save.

The second is thinking about what you want: next month, next year, in 10 years’ time. If you know what you want, you can work your budget around realising those goals. You’ll also stay motivated to save if you can choose and visualise the reward.

On Your Marks, Get Set, Go

One of the most often touted rules of divvying up your income is the 50/30/20 rule. Half of your income must serve your day-to-day living needs, 30% can be spent on your ‘wants’ and luxuries (like the daily Americano, or a subscription, or weekly date night with your partner), and the final 20% must go towards savings and debt.

‘Start small,’ says Nedzamba. ‘Small, regular amounts help you get into the habit of saving and you can increase the amount each year.’ She also suggests setting up a debit order. In this way, you don’t have to make the decision to save.

‘Out of sight, out of mind. There’s less temptation to spend money when it’s not easily accessible. ‘And try to think and plan ahead. As former US president Benjamin Franklin said: “If you fail to plan you are planning to fail”.’

Words by Fresh Living Magazine

Photography: Getty Images